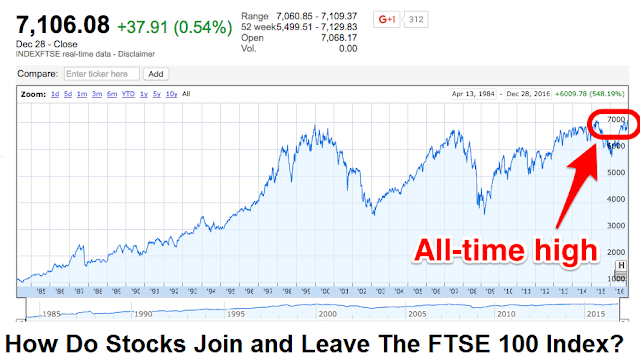

How Do Stocks Join and Leave The FTSE 100 Index?

|

| How Do Stocks Join and Leave The FTSE 100 Index? |

From time to time the index will seem to be full of a high weight given to 1 specific sector, and it may well be argued that nowadays the mining sector (Anglo yankee, Antofagasta, BHP Billiton, Kazakhmys, Lonmin, Rio Tinto, Hinduism Resources and Xstrata) has undue influence. Stockmarket traders can recall the known and dramatic year of 2000 once the FTSE a hundred list contained such passing technology stars like Energis, Bookham Technology, Arm Holdings, Freeserve, port and Psion - nice memories!

Given the increasing use of huntsman funds, it's vital to seem at wherever sector and stock monies ar flowing, as a result of these fund managers ought to match no matter is in every benchmark index, thus new entries and deletions ar price researching by CFD traders before they happen.

The purpose of this paper isn't to debate whether or not or not it's price shopping for or merchandising a replacement constituent, as important educational studies (with some conflicting results) are created on this subject. it's additional a outline of what changes to seem for in assessing attainable constituent moves, and there ar numerous ways in which the FTSE a hundred list may be modified.

Quarterly reviews

This is the foremost common approach for changes to be lagged. The committee that oversees the assorted FTSE indices meets quarterly on the weekday when the primary Friday in March, June, Sep and Gregorian calendar month. Constituent changes ar then enforced on future commerce day following the ending of the LIFFE futures and choices contracts, that commonly takes place on the third Friday of a similar month. The rankings of constituents by worth ar calculated victimization shut of business costs on the day before the review, and corporations should have a minimum commerce record of twenty days at the review.

A company is promoted to the FTSE a hundred index if it rises to ninetieth or higher than once the eligible securities ar hierarchal by value It is relegated if it falls to 111th or below.

Where there ar additional corporations qualify to be inserted in associate degree index than those qualifying to be deleted, the present lowest ranking constituents ar relegated to make sure there ar perpetually a hundred corporations within the index. If there ar additional qualifiers for relegation, the best ranking corporations that don't seem to be already within the index are going to be promoted to match the numbers.

The six highest ranking non-constituents of the FTSE a hundred Index at the time of the periodic review ar called the reserve list, and ar utilized in the event that one or additional constituents ar deleted from the FTSE a hundred throughout the amount up to future quarterly review.

Fast Entry

The second approach an organization will enter the FTSE a hundred index is that if it's a replacement issue and bigger than one hundred and twenty fifth of the complete market capitalization of the FTSE All-Share Index. during this case it'll commonly be enclosed within the high a hundred when shut on the primary day of commerce, and also the lowest ranking constituent is removed.

Eligibility of equities

Only the eligible quoted equity capital is enclosed within the calculation of its market capitalization, thus if an organization has 2 or additional categories of equity, important and liquid secondary lines ar enclosed within the calculation of the market capitalization of the corporate, supported the value of that secondary line.

The committee will decide if a secondary line is to be priced severally if its full market capitalization (before the applying of any investibility weightings) is quite twenty fifth of the complete market capitalization. If the complete market capitalization of a secondary line, that is already a constituent of the Index, falls below 2 hundredth of the company's path at the quarterly review, the secondary line are going to be deleted from the index, however this happens seldom.

Convertible preferred shares and loan stocks ar excluded till reborn.

Rights or alternative problems

If an organization problems shares, part or aught paid, and also the decision dates ar already determined and famed, the market capitalization is adjusted thus on embrace all such calls, which might mirror the whole absolutely shares in issue.

Mergers and takeovers

If a merger or takeover leads to one constituent within the FTSE a hundred index (or FTSE 250 for that matter) to be absorbed by another constituent, there's a vacancy within the acceptable index. the best ranking security within the acceptable Reserve List as at the shut of the index calculation 2 days before the deletion is chosen.

If a constituent company within the FTSE a hundred or FTSE 250 is taken by a non-constituent company, the initial constituent are going to be removed and replaced by the best ranking non-constituent on the acceptable Reserve List.

The company ensuing from the takeover is but eligible to become the replacement company if it's hierarchal beyond the other company on the Reserve List.

Company splits or demergers

If a member of the index is split or demerged into 2 or additional corporations, the ensuing corporations ar eligible for inclusion as index constituents in their title. this can be once more supported every new company's market capitalization (before the applying of any investibility weightings).

It may be that very cheap ranking FTSE a hundred constituent gets relegated to the FTSE 250, thus once GUS demerged into Home Retail and Experian last October, Party diversion was sadly relegated.

Comments

Post a Comment